"Confused between a Line of Credit, Credit Card, and a Loan? This blog breaks down all three in the simplest way—how they work, how they differ, and real-life examples to help you choose the right borrowing option."

Published: 11 December 2025

Updated: 20 January 2026

In the fast-paced financial world, we are spoilt for choice. Whether you want to buy the latest smartphone, renovate your home for Diwali, or just keep a safety net for medical emergencies, there is a financial product for every need.

But this abundance of choice brings confusion. You have Credit Cards in your wallet, offers for Personal Loans in your emails, and now, banks are offering something called a Line of Credit (LOC) directly on UPI apps.

Which one should you pick? Choosing the wrong one could mean paying 36% interest when you could have paid 12%. Or getting stuck with a fixed EMI when you needed flexible repayment.

If you have ever searched for the "difference between a line of credit and credit card", you are in the right place. This guide will decode these three borrowing tools with simple examples so you can borrow smart, save money, and stay stress-free.

Note: My Mudra is a marketplace that connects borrowers to RBI-registered banks/NBFCs. Final eligibility, approval, and interest rates are always decided by the lender.

Looking for the right financial fit? Don't guess. Explore borrowing options on My Mudra to connect with India’s top banks and NBFCs tailored to your profile.

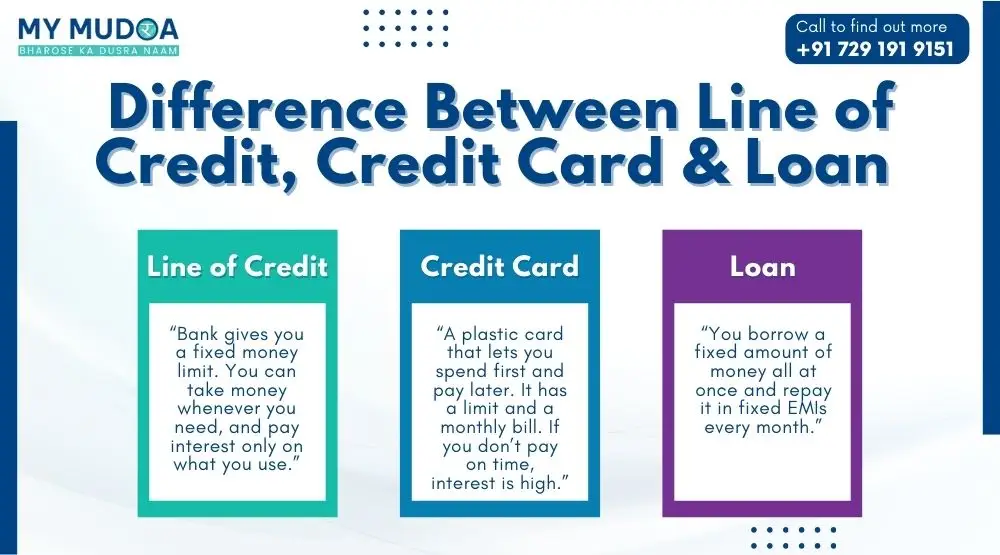

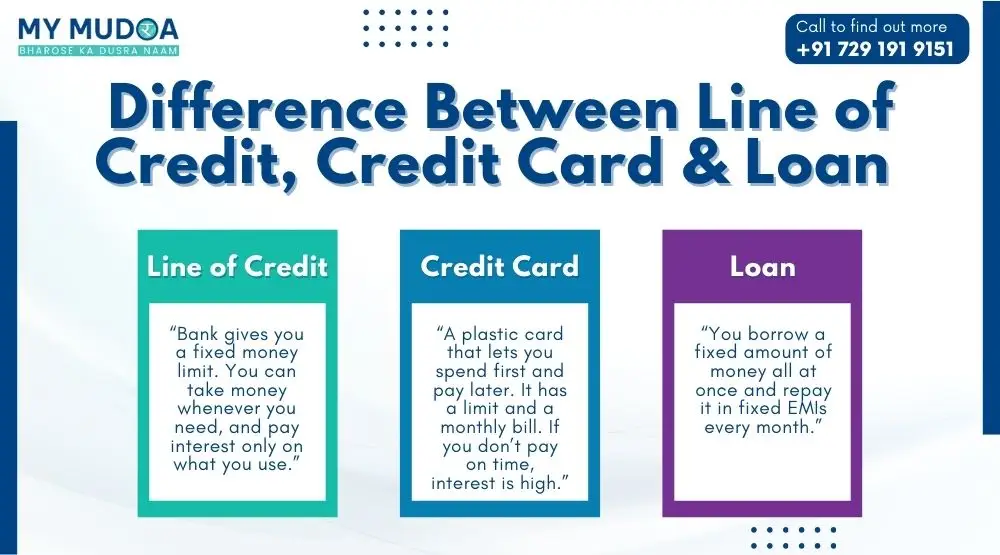

Think of a line of credit as a magical wallet that refills itself.

It is a flexible borrowing facility where a lender approves you for a specific limit (e.g., ₹5 lakhs). Unlike a personal loan, this money doesn't hit your bank account all at once. It sits in a loan account. You can withdraw ₹50,000 today, ₹20,000 next month, or nothing at all.

The Golden Rule: You only pay interest on the amount you use, not the total limit sanctioned.

1. Personal Line of Credit (Unsecured): Approved based on your salary and CIBIL score (700+). No collateral needed.

2. Secured Line of Credit: Offered against your Fixed Deposit (Overdraft) or Property. Interest rates are much lower here.

3. Credit Line on UPI: The 2026 game-changer. You can now link a pre-sanctioned credit line to your UPI app (like Google Pay or Paytm) and pay shopkeepers directly by scanning QR codes, without using a credit card.

A credit card is the most common form of "revolving credit." It’s a plastic (or metal) card that lets you buy now and pay later.

The Risk (Debt Trap): If you only pay the "Minimum Due" (usually 5% of the bill), the remaining amount attracts a massive interest rate of 36% to 42% per year. This is why credit cards are great for spending but terrible for long-term borrowing.

A personal loan is a versatile financial product that offers funds without requiring collateral or security. It is characterized by minimal documentation and can be used for a variety of purposes.

Here is a quick snapshot to help you spot the difference between a line of credit and a loan at a glance.

|

Feature |

Line of Credit (LOC) |

Credit Card |

Personal Loan |

|

Flexibility |

High. Withdraw & repay anytime. |

Medium. Spend & pay monthly. |

Low. One-time lump sum. |

|

Interest Charged |

Only on the amount used. |

On the unpaid bill amount (after due date). |

On the entire loan amount. |

|

Interest Rate |

Moderate (13% - 18%) |

Very High (36% - 45%) |

Low to Moderate (10.5% - 24%) |

|

Repayment |

Flexible (Interest-only or Principal). |

Full payment recommended monthly. |

Fixed Monthly EMI. |

|

Reuse |

Yes, limit refills on repayment. |

Yes, limit refills on payment. |

No. Once closed, apply again. |

|

Best For |

Recurring/Unknown expenses. |

Daily shopping & Rewards. |

One-time large expense. |

Interest rates are the "price" of money. Here is what you can expect in the current Indian market.

Lowest for: Salaried employees with 750+ CIBIL score.

Note: Secured LOC (Loan Against FD) is much cheaper, often FD Rate + 1% (approx 8-9%).

Warning: This only kicks in if you miss the full payment by the due date. Cash withdrawals from ATMs using a credit card also attract this rate from Day 1.

Note: These are indicative ranges. Your actual rate depends on your credit score and the lender you connect with via My Mudra.

Let’s solve the line of credit vs credit card confusion with real stories.

Here is your cheat sheet for decision-making.

|

Best Option For... |

Line of Credit |

Credit Card |

Personal Loan |

|

Small recurring expenses |

Great (if cash needed) |

Best (for shopping) |

No |

|

Large one-time expenses |

Interest can be higher |

Limit may be low |

Best (Lowest Rate) |

|

Business/Working Capital |

Best (Flexibility) |

Too expensive |

Only if fixed need |

|

Emergency Fund |

Best (Standby cash) |

Good for payments |

Takes time to disburse |

|

Avoiding Overspending |

Requires discipline |

High risk of debt |

Best (Fixed schedule) |

Digital KYC makes it quicker than ever to get approved in 2026. Eligibility Basics:

Do you want to get started? It is possible to apply for a line of credit online or check your eligibility for a personal loan through My Mudra.

Note: My Mudra is a marketplace that connects you with RBI-registered lenders. We do not lend money directly.

Choosing between a line of credit vs a credit card or a line of credit vs personal loan comes down to one question: Why do you need the money?

Still unsure? Don't worry. You don't have to navigate this alone. Explore your Line of Credit or Personal Loan options with My Mudra today. We help you compare offers from India's top lenders so you can borrow with confidence.

Also Read:

- Personal Line of Credit in India: Eligibility, Interest, Rates, Pros & Cons

- Line of Credit Interest Rates in India (2026): How Much Do Banks Charge?

💬 Comments

Leave a comment or ask a question!

Please Enter Your Name

Please Enter Your Email

Please Enter Your Phone

Please Write Your Comment