Business Overdraft Loan – Get Instant Access to Extra Funds

Keep your business running smoothly with instant access to extra funds. Manage cash flow gaps, meet working capital needs, and cover unexpected expenses with a Business Overdraft Loan from My Mudra. Enjoy quick approvals, minimal paperwork, and flexible repayment options tailored for your business growth.

-

Flexible Usage

-

Instant Approval

-

Pay Interest Only on Used Amount

-

For Small & Medium Business Owners

-

No-collateral required

Last Updated: 22 December 2025

Get Your Business Overdraft Today

+91

+91

Verify Captcha

Solve the puzzle

Trusted by our customers

Trusted by

our customers

Business Overdraft Loan EMI Calculator

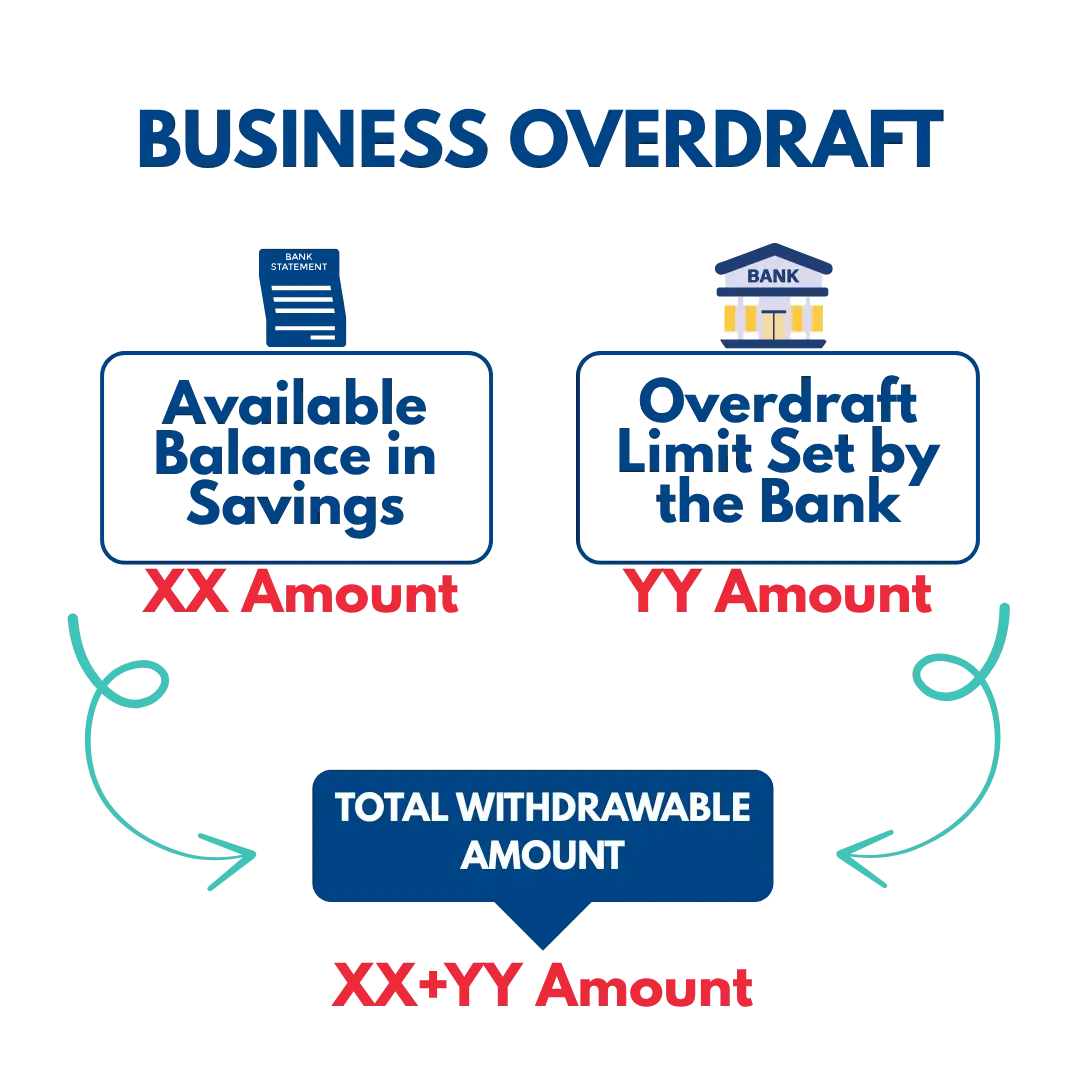

What is a Business Overdraft Loan?

A business overdraft loan or an OD loan for business is a credit facility. It lets you withdraw more money (up to an approved limit) than what is available in your current account. You only need to pay interest on the amount you use and for the number of days you use it.

This is a smart solution for businesses that want a flexible way to manage expenses. An overdraft does not require you to borrow a fixed amount for a fixed period. You can withdraw, repay and withdraw again within your sanctioned limit. It gives you complete control over your cash flow.

Features of Business Overdraft Loan

Loan Type

Revolving credit facility for businesses

Loan Amount

It is based on your business turnover. It can be from ₹1 lakh to ₹1 crore

Interest Rate

The competitive overdraft interest rates start from 9.5% p.a.

Tenure

It is from 12 months to 36 months. It is renewed annually

Collateral

Both secured and unsecured options are available

Repayment

Flexible, repay anytime within the tenure

Processing Time

Instant approval and quick activation

Benefits of Business Overdraft Facility

Quick Cash Flow Support:

It can manage your working capital needs, pay suppliers and cover operational expenses instantly.

Flexible Withdrawals:

Withdraw funds as much as you need. You can repay when you receive payments from customers.

Pay interest only on Used Amount:

You only have interest on what you actually use. It is not the entire limit.

No Fixed EMIs:

Repay as per your convenience within the agreed limit period.

Continuous Access to Funds:

You can get funds as many times as you need during the tenure. No need to reapply each time.

Eligibility Criteria for Business Overdraft Loan

To qualify for an overdraft loan for business through My Mudra, you must meet basic eligibility criteria:

- Age: 21 to 65 years

- Business: At least 3 years of continuous operations

- Turnover: Minimum annual turnover as per lender requirements

- Credit Score: Preferably 700+ for unsecured overdrafts

- Banking History: Good account statement for the last 6 to 12 months

Who Should Apply for a Business Overdraft?

You can apply for an overdraft business loan if you:

- Have a small business that has sales and cash flow

- If you need funds for paying suppliers, salaries or meeting urgent working capital requirements

- Want a flexible alternative to your fixed-term business loans

- Have a retail shop, manufacturing unit, trading business or service business that faces cash flow gaps

Documents Required for Business Overdraft

Applying for a business overdraft loan online is simple and paperless with My Mudra. Keep these ready for faster approval:

- Identity Proof (Aadhaar card, PAN Card, Passport)

- Business Proof (GST registration, Udyam certificate)

- Bank Statements from the last 6 to 12 months

- Address Proof (Utility bill, rental agreement)

- Recent Passport-size Photograph

Apply online for a Business Overdraft Loan and get your loan approved fast. Upload these securely on the My Mudra platform to get your profile assessed quickly.

How to Apply for Business Overdraft Online

Top Banks and NBFCs Offering Business Overdraft Loan

Here’s a comparison of interest rates, limits and features from leading banks and NBFCs that give you a business overdraft facility:

| Lender | Interest Rate (p.a.) | Overdraft Limit | Processing Fee | Renewal / Tenure |

|---|---|---|---|---|

| HDFC Bank | Starting at 9.5% | ₹1 lakh - ₹50 lakh | Up to 2% of limit | Annual renewal available |

| ICICI Bank | 9.75% - 12.50% | ₹1 lakh - ₹1 crore | Up to 2% of sanctioned amount | 12 months, renewable |

| Axis Bank | Linked to Repo Rate | Up to ₹50 lakh | 1% - 2% of limit | 12 months, renewable |

| Kotak Mahindra Bank | Starting at 10% | ₹1 lakh - ₹1 crore | Up to 2.5% | Annual limit review |

Note: Interest rates and fees can change. It is based on your business profile and lender policy.

Tips to Get Business Overdraft Approved Quickly

- You should maintain a good credit score. You can get it by paying suppliers and EMIs on time.

- Keep your financial records updated. It helps you with easy verification.

- Apply for a realistic overdraft limit based on your turnover.

- You should avoid multiple applications with different lenders simultaneously.

- Use trusted platforms like My Mudra for faster processing and better rates.

Frequently Asked Questions (FAQs)

What is the overdraft interest rate for businesses?

Interest rates usually start from 9.5% p.a. They are charged only on the amount used.

Is a business overdraft loan secured or unsecured?

Both options are available. You can get an unsecured business overdraft based on your credit score and business performance.

How quickly can I access funds after approval?

With My Mudra, you can get access within 24-48 hours once your limit is approved.

Can I use the overdraft multiple times?

Yes. It is a revolving credit facility. It lets you withdraw, repay and withdraw again within the limit.

What will happen if I don’t use the overdraft?

You are not charged interest if you do not withdraw funds from the limit.

Pay Bill

Pay Bill