"Learn how to calculate your credit utilisation ratio and discover simple, effective strategies to manage your credit card limits wisely for better financial health."

Published: 7 November 2025

Managing your credit carefully is important because it keeps your finances healthy. One way to check your credit health is your credit utilisation ratio. This shows how much of your available credit you are using. Banks look at this to understand your borrowing habits.

Let's explore what the credit utilisation ratio is. You will see how to calculate it, why it matters, and ways to reduce it.

Your credit utilisation ratio tells you how much of your available credit you are using. Simply add up the total credit on all your cards and see how much you have spent. Then you can calculate it as a percentage of your total credit limit.

Your credit utilisation ratio matters because it sends signals to banks. It lets them know how well you manage your existing credit. If you use a big part of your available credit, it can show that you are under financial pressure or depending too much on credit. This can lower your credit score and make loans harder to get.

Here are reasons why you should keep an eye on this:

Then apply this formula:

If your ratio is 40 % it means you are using 40 % of your total available credit

Example:

|

Credit Card |

Credit Limit |

Outstanding Balance |

|

Card A |

₹50,000 |

₹10,000 |

|

Card B |

₹25,000 |

₹5,000 |

|

Total |

₹75,000 |

₹15,000 |

It becomes: (₹15,000 ÷ ₹75,000) × 100 = 20 %

Here, your credit utilisation ratio is 20 %

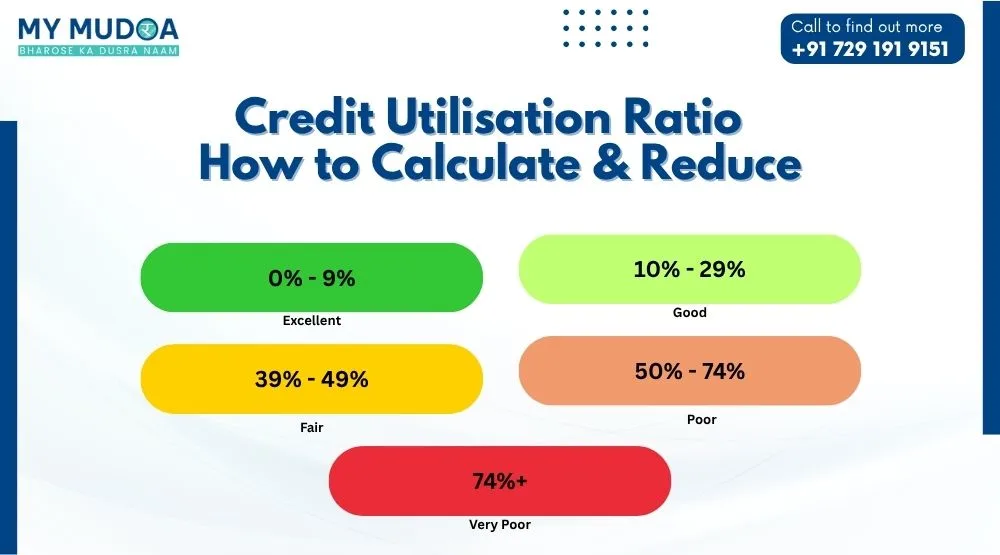

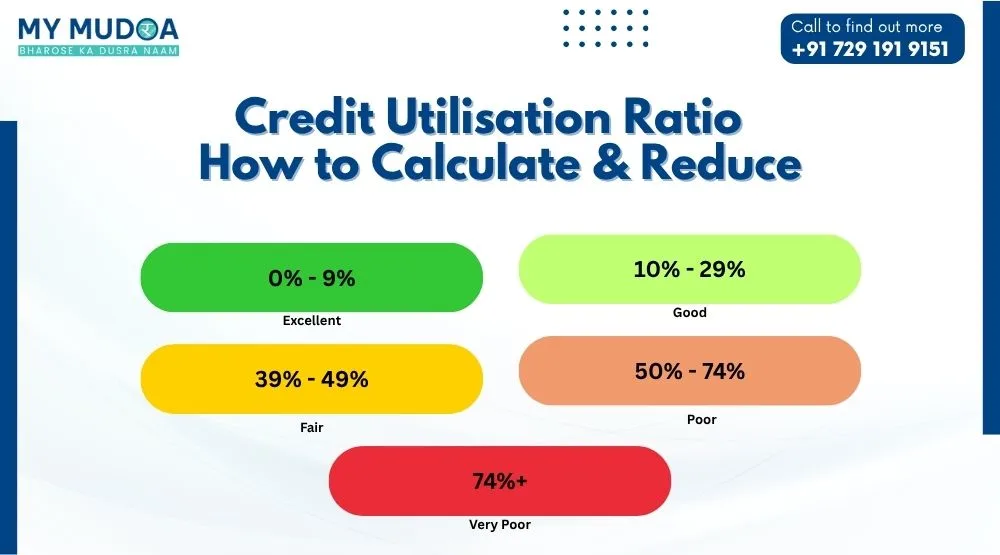

There is no single “perfect” number, but financial experts generally agree that keeping your credit utilisation below 30 % is a good rule of thumb in India. In fact, some sources say the lower the ratio, the better. Even single‑digit percentages can be ideal, as long as you still demonstrate you can use credit and repay it.

Even if you keep your credit utilisation low, you still must pay your bills on time, maintain a healthy credit mix, and avoid unnecessary credit applications. The ratio is one piece of the puzzle.

Here is how you can lower your ratio and keep it under control:

The easiest way is to lower what you have. The less debt you have compared to your credit limit, the better. If you pay more than the minimum each month, your balance will go down faster.

If you have multiple cards, distribute your spending so no one card has a very high utilisation. The overall ratio benefits when limits across cards are used in moderation.

If you have a good payment record, you may ask your card provider for a limit increase. If your spending remains the same, a higher limit lowers the ratio.

Closing a card reduces your total available credit, which can raise your ratio if your spending remains the same. It also may shorten your average account age.

Sometimes your outstanding balance is reported before your payment is credited. If possible, pay down the card before the statement is generated so that the reported utilisation is lower.

If you know you will make a large purchase, plan ahead. Perhaps use a debit card, or spread the purchase over time, so your credit utilisation does not spike for the statement cycle.

Your credit utilisation ratio affects your credit score and borrowing prospects. By calculating it accurately, aiming to keep it low, and using the strategies mentioned above, you place yourself in a stronger position. You do not have control over every factor, but utilising credit carefully and keeping your utilisation ratio in check is a practical step you can take today towards better credit health.

Also Read:

- Advantages and Disadvantages of Credit Card

- Top Benefits of Having a Good Credit Score

A good credit utilisation ratio in India is typically 30% or lower of your total available revolving credit. However, the lower the better, provided you maintain regular usage and timely payments.

Add up all your outstanding balances on credit cards. Add up your total credit limits across those cards. Then divide the outstanding by the total limit and multiply by 100 to get a percentage.

Yes. A high credit utilisation ratio is often viewed negatively by credit sections because it may signal that you are heavily using your available credit and might be at risk of default. So it can pull down your score or make accessing new credit more difficult.

Yes. Lowering your credit utilisation ratio can help banks see you more positively. This ratio is an important part of your credit score. If you reduce it, your credit score may go up over time. This works best if you also pay your bills on time and follow other habits.

💬 Comments

Leave a comment or ask a question!

Please Enter Your Name

Please Enter Your Email

Please Enter Your Phone

Please Write Your Comment