Apply for Credit Card

TYPES OF FIRST

CREDIT CARDS

First Select

A card that comes with premium features and gives you unlimited access to the airport lounge.

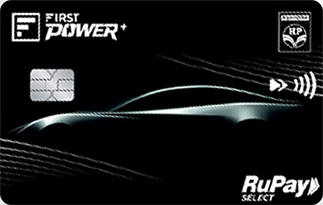

First Power

Savings on mobility, utility, and other everyday expenses with First Power Card. Enjoy unlimited benefits.

First WOW

Utilize your fixed deposit, get First WOW Card, and avail of privileges in addition to the interest rate on the card.

First Millennia

A card designed for the Millennial lifestyle. Comes with unlimited rewards, cash back, and much more. .

First Classic

A card that seeks good value and exceptional rewards. Save more than 7000 just by using the card.

First Wealth

Privileges like no other card. Unlock travel benefits, and evergreen rewards on this card.

Pay Bill

Pay Bill