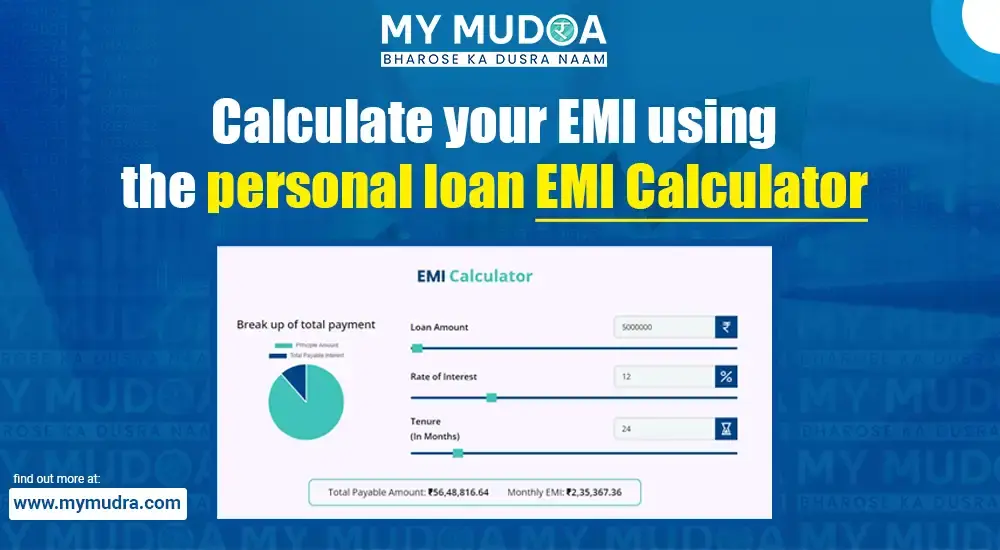

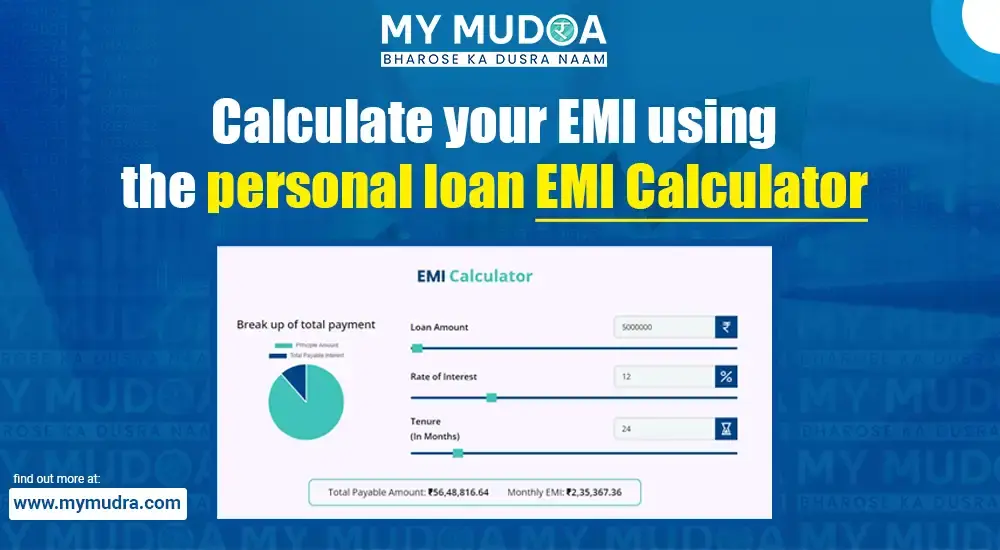

"Find out how to manage your EMIs with our Personal Loan Calculator. Plan your repayments efficiently and stay in control of your finances."

Published: 14 February 2025

Updated: 8 November 2025

Applying for an instant personal loan is a solution to various financial requirements, from weddings, vacations, and studies to emergencies. Multiple factors must be considered before taking a loan to ensure the timely repayment of EMIs. One must know the EMI amount before taking the loan to confirm one's affordability. More often than not, borrowers also need to calculate and compare EMIs for different loans to find the most suitable one.

Calculating this EMI amount and factoring in the principal amount, interest rate, and tenure can be tricky, but not with a personal loan EMI calculator. It is an easy-to-use, quick, and accurate online tool to help borrowers make the right decision when borrowing a loan.

In this blog, we are going to hold a comprehensive discussion on a personal loan repayment calculator. How does the calculator work? How do you use it? What are its benefits? We will be answering these questions and more. Read on!

A personal loan EMI calculator helps calculate the Equated Monthly Installment, commonly called EMI. This free, online tool asks for three basic inputs - the loan amount you want to borrow, the interest rate quoted to you, and the tenure (in months or years) you find suitable.

Once the data is input, the calculator crunches the numbers instantly. The three crucial details the personal loan EMI calculator provides are:

The formula to use when calculating personal loan EMIs is [P x R x (1+R)^N]/[(1+R)^N-1].

Here,

In case you are wondering, the sign ‘^’ in the EMI calculation formula for personal loans represents exponentiation – raising a number to a power. If this formula seems too difficult and time-consuming, you are not alone in that thought. It requires great skill and accuracy to use this formula and successfully calculate the EMI. The task becomes more complicated when you need to compare the EMIs of different loan options. The personal loan EMI calculator will apply the same formula and get the job done faster and with assured accuracy.

Suppose you wish to borrow ₹10 for 5 years at an interest rate of 12%. So, how to calculate EMI for a personal loan? Simply open the EMI calculator and enter the said details. On your screen, you will see the EMI amount that is ₹22,244, the total repayable amount that is ₹13,34,667, and also the interest and principal breakdown that is ₹3,34,667 + ₹10,00,000.

Calculating the EMI before a personal loan is necessary to stay on top of your financial obligations. Using a calculator to calculate the EMI will benefit you in many ways, making the loan application process and repayment easier.

Manual EMI computation can take a long time. An EMI calculator simplifies the calculation process, offering instant and correct results within a few seconds without requiring any more effort from you than typing a few numbers.

Knowing your EMI in advance allows you to check if it aligns with your monthly budget. It prevents loan repayments from impacting essential costs like rent, food, and utilities. By reducing the risk of cash flow shortage, the calculator helps improve financial planning.

You can quickly calculate the EMI amounts for different loans offered at varying interest rates and tenures using an EMI calculator. This way, you can find the best plan and simplify repayment for you by comparing different options without spending hours.

By tweaking the variables in the calculator, you can see how varying the tenure or interest rates impacts your EMI. This makes you an informed borrower, enabling you to choose a loan plan that suits your financial objective and repayment capacity.

You can easily use My Mudra’s free online EMI calculators anytime you want. It is greatly beneficial, considering financial requirements and emergencies don’t always notify before arriving.

A personal loan eligibility calculator is an online tool, similar to an EMI calculator, designed to help with borrowing decisions. Here are the key differences between the two:

|

Parameters |

Personal Loan EMI Calculator |

Personal Loan Eligibility Calculator |

|

Purpose |

Assists borrowers in calculating their monthly EMI amount |

Calculates the eligibility of the borrowers and the highest amount of loan they can receive |

|

Factors Considered |

Loan amount, interest rate, and loan tenure |

Monthly income, current financial obligations, credit score, employment stability, and debt-to-income ratio |

|

Assistance in Financial Planning |

By offering a clear idea of the EMI and allowing borrowers to plan their finances accordingly |

By providing an estimate of how much one can borrow without financial stress |

Make sure you plan your personal loan right and ensure stress-free borrowing with a personal loan EMI calculator. While this tool helps in various ways to streamline and simplify the borrowing process, it does so with accuracy and without any cost. It presents all the numbers to you before you take a loan so that you can make the right borrowing decision and make timely payments. The penalty for missing EMIs and defaulting is not limited to fines. It can also affect your credit score and future chances of getting approved for loans. The EMI calculator will help you stay informed from the very beginning to avoid any surprises or shocks down the road.

Ready to plan and manage your loans smarter? Use My Mudra EMI Calculator now and take control of your finances with confidence!

Also Read:

- Calculate your Loan Eligibility Online with our EMI Calculator

- Get 10 Lakh Personal Loan Online in Minutes at low EMIs

To calculate EMI, use this formula: [P × R × (1 + R)^N] / [(1 + R)^N - 1].

Here, P is the loan amount, R is the monthly interest rate that you can find by dividing the yearly rate by 12, and N is the loan tenure in months. You can also use an EMI calculator instead of manually calculating for a faster and more accurate calculation.

The EMI depends on the interest rate and tenure. For example, at 12% annual interest for 5 years, the EMI would be around ₹11,122 per month.

To check your personal loan eligibility, use an online calculator. Enter the loan amount, interest rate, and tenure, and it will show the EMI amount, total borrowing cost, and the interest and principal breakdown.

The EMI for a ₹20 lakh personal loan varies based on the interest rate and tenure. For example, at 10% annual interest for 5 years, the EMI is around ₹42,494 per month. You can use an EMI calculator for precise estimates.

💬 Comments

Leave a comment or ask a question!

Please Enter Your Name

Please Enter Your Email

Please Enter Your Phone

Please Write Your Comment